Provided you read this and you are the person keeping a whole family on one salary, I address you not like a financial expert who is selling you the dream, but like a person who understands the situation.

This applies to those parents that take a second look at the grocery slip before storing it away.

To those who sacrifice themselves to the benefit of their children so that they can live.

To the people who are proud and at the same time, they are tired.

Not just living but creating some sort of life with not a peep. And you want to have financial freedom, as well. Financial independence does not necessarily refer to yachts and in early retirement.

In some cases it simply translates to breathe easier. It implies that you are not putting yourself under pressure about paying the rent. It refers to purchase of medicine without raiding grocery funds.

It is an option. Calm. Space. That type of peace may seem beyond your reach to the single income families. However, it is not the case. Not when we do it differently – not with cannon ball propaganda, but deep at heart to a straight point.

Redefining What Financial Freedom Means for You

You are not alone if you ever drew the analogy of your experience with the two-earner household.

One feels that he/she is falling behind. However, there is a worthwhile thing to say, financial freedom is not a number.

It is an emotion. It is a beat. It is being in charge of your life, what you owe, what lies ahead. It is more deliberate when you create this type of freedom with a single-income. But it also forms increased strength. Each decision has a weight.

Any victory is concrete. Each dollar is being utilized more.

Enough with the focus on what you don t have, it is time to create upon the gifts you do have: strength, insight and determination to achieve more on the behalf of the people you care about.

The Emotional Pressure Behind the Numbers

Every budget has a story of a person. Behind each retrenchment a discussion.

And when a family or a spouse is bearing the entire financial burden of the family, it is not just money that is spent.

It has got mental energy. Stress. Self-doubt. And more than often, to silence.

Perhaps you just don’t speak up on it since it is your duty to get it into hand.

Or perhaps your worse half at home feels useless since he/she is not earning.

In any case, the pressure exists. To put it bluntly, we might as well call it the way it was, the system is heavy and you are not just carrying bills. That is why to be free financially is not all about money. Healing the money-related pressure is about it.

Starting With Visibility, Not Control

It does not seem to make sense to budget when all the dollars are committed.

You may say to yourself, What is it all about? We are still empty handed.” But it is not about control in budgeting. It is all about the visibility.

The minute you get an opportunity to observe where your money really goes, where it drains, where it hoards, where it stagnates, you see then that you understand it.

It is not the self punishment for minor pleasures. That is choosing the place where your money will be.

Perhaps you are aware of your streaming subscriptions summing up. Perhaps you realize that weekend take-out is as expensive as a box of groceries.

It is the aim not to reduce, but to select. It does not matter whether something will change today or not. The fact that you look will make you feel empowered. And What authority was that quiet? It is the point of the beginning of the liberty.

Saving Isn’t a Luxury | It’s a Safety Net You Deserve

In case you simply cannot save right now, listen to this: you do not have to save big at the very beginning.

All you have to do is to save something. Not because it will turn into millions within an instant, but that it allows you a buffer between you and anarchy.

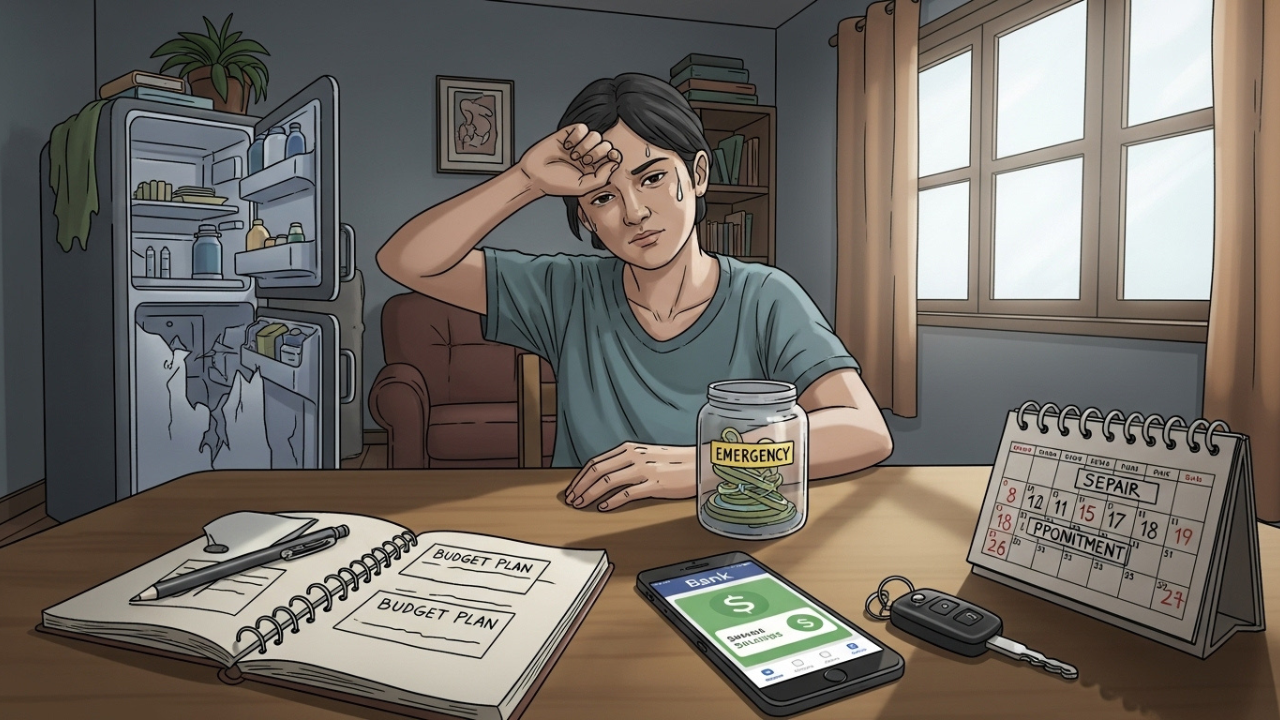

Suppose it is a month when something goes wrong, when you break a tire or a refrigerator or a dental filling in your son or daughter. In the absence of savings such a time turns into a crisis.

Even when you have a small reserve saved it becomes an issue – an issue that can be resolved, accepted and overcome. You would not save in case to be rich.

To save your peace you guard your savings. and that is your own peace, whether your earnings be large or small.

Save five dollars a week as far as that will go. Rebaptize the account and call it the freedom fund. Whenever you watch it thrive you are psyching yourself: I am not helpless. I am training.

Building A Gentle Path Toward Passive Income

Passive income may seem like a joke to such families as yours.

Who can start an online YouTube channel or buy a house when your partner is sitting at home with the children and you are working 50 hours each week.

The passive income does not always need to be glamorous. Perhaps your husband creates a printable planner on the nap time.

Perhaps, you sell used children clothes on the Internet. Perhaps, it is a referral program to a product you use. It is not the dream of having an overnight success.

The way is to build small ideas on top of each other. You are not working on building a brand. What you are seeking to develop is breathing room. And each of the dollars which you receive by the water-courses,–without selling any more time–is a step towards your emancipation.

Letting Your Family Join the Mission

The following is one of the things that many may not be saying: financial freedom belongs to the person who earns it.

That is a family work. It does not imply that you push the weight on your children or that you request that your partner gets money.

It is travelling together. Be open when it comes to money. And, have small celebrations together achievement of a small financial goal such as a milestone in savings or cancellation of a credit card.

Show your children how to be patient, to plan and to enjoy. Involve your partner in the financial choices even in case he/she does not work in order to provide, as emotional labor is essential too.

Once everyone feels they belong to the mission, the load is not heavy. You begin to feel like team. And it is that cooperation that builds not only dollars, but that is what builds dignity.

Why Investing Isn’t Off Limits For You

Perhaps, you have been afraid of investing due to the feeling that this is something that is not meant to be done by people like you; then hold on.

Investing should not be associated with the possibility of losing all of your paycheck or gambling through the stock market.

It is the seeds that are planted but when you are still busy working and parenting. You may begin with retirement account at work.

Or some minutely sized index fund. It even counts to set aside a part of your tax refund to invest.

It does not matter how much it is, but how many times a day. You invest so as to guard the future you.

So that your money can come further than your time would ever. You invest to enable yourself to be able to say yes more tomorrow because it is not a gift that you have the rights to do so; it is something that you have to earn yourself.

Real Progress Isn’t Loud — It’s Quiet And Consistent

When we discuss money we expect a drama sometimes. Big wins. Huge gains.

Overnight Success stories. However, to the solitary income families, real economic growth will somehow be uninteresting. And that is a positive thing. Development may be refusing a third streaming membership.

It can be shifting 20 dollars saved from checking into savings so that nobody knows.

It could be your husband or wife preparing the food rather than ordering delivery not to be guilty but sharing an intention.

These moments do not go viral in social media. But they are the ways through which men like you make liberty. Quietly. Daily. Steadily. And that silence creates confidence, in your self, in the work you do and in the destiny awaiting you.

What To Do When Emergencies Set You Back

Now about the dirty side. Emergencies. When that fridge becomes nonfunctional.

When it is time to repair the car. When somebody is ill and your budget is striking. This would not have happened but will do so. That is no negativity – that is life. Here is the point clearly: a backlash is not a failure. Your being able to recover in any way at all, is a sign that your system is functioning.

Perhaps, you are liquidating your small savings. That is success not defeat. It means you are a planner.

This implies you made it through the storm. Never be harsh on yourself because you are using it. And that was what it was to be.

It is important to rebound following the blow. Even at the rate it is slow. Even though it may require months. Since the reconstruction is a part of the rhythm. No side amount of it–side of the way.

Investing With Trust, Not Fear

In Part 1, we took off easy on investing. It is time to feel comfortable with it.

One does not have to know all about the stock market before starting. trust is what you need. Have faith that you do not have to pursue every headline in order to grow.

Then take faith in knowing you can begin small but in the end and reality, great things will happen.

A beginning platform/method should feel comfortable. Check your retirement plan at the workplace, in case there is one.

Otherwise, sign up to a small investment account online and test a broad index fun.

Automate contributions Put in place automatic contributions even as little as $10 a month. Your money is not only increasing by rate, it is also increasing by rhythm. And you are not supposed to cheat the game. It is your job to make sure that you stay in the game.

Including The Non-Earning Partner In Growth

In single income families, there is silent burden which keeps on the shoulders of a non-earning person.

In many cases, they believe that they are not doing their part despite they take care of the household, bringing up children or taking care of aging family members. Here is where we can make corrections on that. It is not the money that makes everyone financially free. Teamwork constructs it.

The one at home can manage the budget, shop around, establish the side projects on the slow time, or just offer emotional support. Such things count.

It is important to have a relaxed house. A nurtured child is a difference maker.

Not that it makes a difference, but a partner that does not freak out with the words of “We will work it out” would be more important than we realize. Look at the unit then because it is not who earns and who does not earn. You are a financial outfit. And there is no small contribution.

Teaching Kids About Money Without Stress

Kids observes more than we think. They can visualise no in your mouth. They listen when you are talking about bills.

They feel the strain at the time of paying rent. Therefore, discussing money with them is not only convenient, it is a therapeutic thing.

Provoke fear in them you do not have to. These are just being truthful. Demonstrate to them the concept of savings.

Let them assist in picking groceries or expenditure. Request them to identify targets – even anything concerning toys.

It does not only develop their knowledge but also makes them feel like they belong, respected and strong. And those children who were brought up with the attitude that money is secure, usually become adults who handle it with ease.

Reducing Emotional Spending Without Shame

Honestly speaking, we all spend to comfort. One snack here, a few take- outs there.

When we are under stress, tired and unconnected, particularly. It is not a personality defect.

It is human tendency. However, spending in the name of emotions may undermine our gains.

Replace it subtly instead of making it illegal. Pay attention when you spend in order to make yourself feel better.

Pause. Breathe. Put some questions to yourself: What is it that I really need now? Occasionally it is rest. Connection is sometimes the case.

Other times it is taking a walk or being still. The more you give attention to your emotions rather than trade in them, the more you will control them.

What then happens should you fall? That’s okay. The thing is you do not want to be perfect. You are trying to get peace.

Redefining Richness On Your Own Terms

All advertisements convince you to purchase more. All the highlights say that others have got more.

Or it can make you think that you are up to no good leading a simple life. Wealthiness does not always manifest.

It is not necessarily gauged by the square footage, or the brand of vehicle.

To you, perhaps being wealthy is not having to go into your bank app to ensure you have the money to take your child to the playground. Perhaps it is the cooking process rather than the scrolling takeout.

Perhaps it is not feeling a humongous weight in your chest when you wake up. It is these times, when everything is so peaceful, conscious, interconnected that are the true barometers of the wealthy. Do not believe what anyone tells you.

My Opinion

The path is not easy folks. It takes courage of you to do it. You are decided to create peace in a system which desires you wore out.

You are single handedly sustaining a family with the one income and yet you are still managing to expand.

We do not get the benefit of financial freedom overnight. It comes in the form of repetition.

With little everyday decisions nobody notices. In all the times you did not quit where you had the opportunity.

At this time, you are already on the way. You are on it even though crawling today. And the life which you are making, with patience, and love, and steel, is all the good, hard steps.